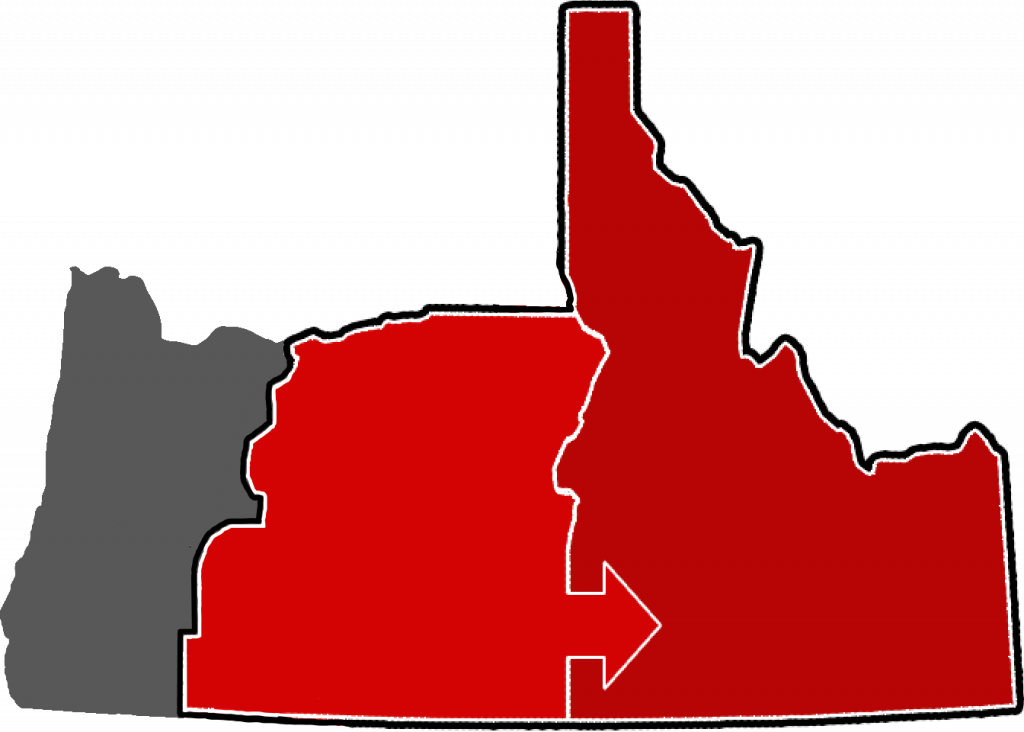

Join the movement to relocate the Oregon/Idaho state line to make both states better.

Counties can become a part of Idaho. State lines have been relocated many times in American history because it just takes an interstate compact between two state legislatures and approval of Congress.

If the United States were governed as a single state, we wouldn’t have the opportunity for state governance to vary according to the culture of a local area. The purpose of having state lines is to allow this variance. The Oregon/Idaho line was established 163 years ago and is now outdated. It makes no sense in its current location because it doesn’t match the location of the cultural divide in Oregon. The Oregon/Washington line was updated in 1958. It’s time to move other state lines.

Upcoming Events

Election Day

May 21, 2024

Get out and VOTE! Find out who your candidates are that support Greater Idaho and support them! And be sure to encourage everybody who lives in Crook County to vote yes on Greater Idaho!

Click to Read More »

Josephine County Patriots Conference

April 27, 2024

Greater Idaho President Mike McCarter will be presenting at the Josephine County Patriots Conference on April 27 at the Josephine County Fairgrounds Floral Room. Mike will be speaking at 2:30.

Click to Read More »

Crook County Open Q and A

April 24, 2024

Got Questions before Voting? Come ask them at our Q&A! On Wednesday, April 24th, at the Crook County Library in Prineville, Executive Director of Greater Idaho Matt McCaw will be hosting a question and answer open forum. Come ask questions you ha...

Click to Read More »