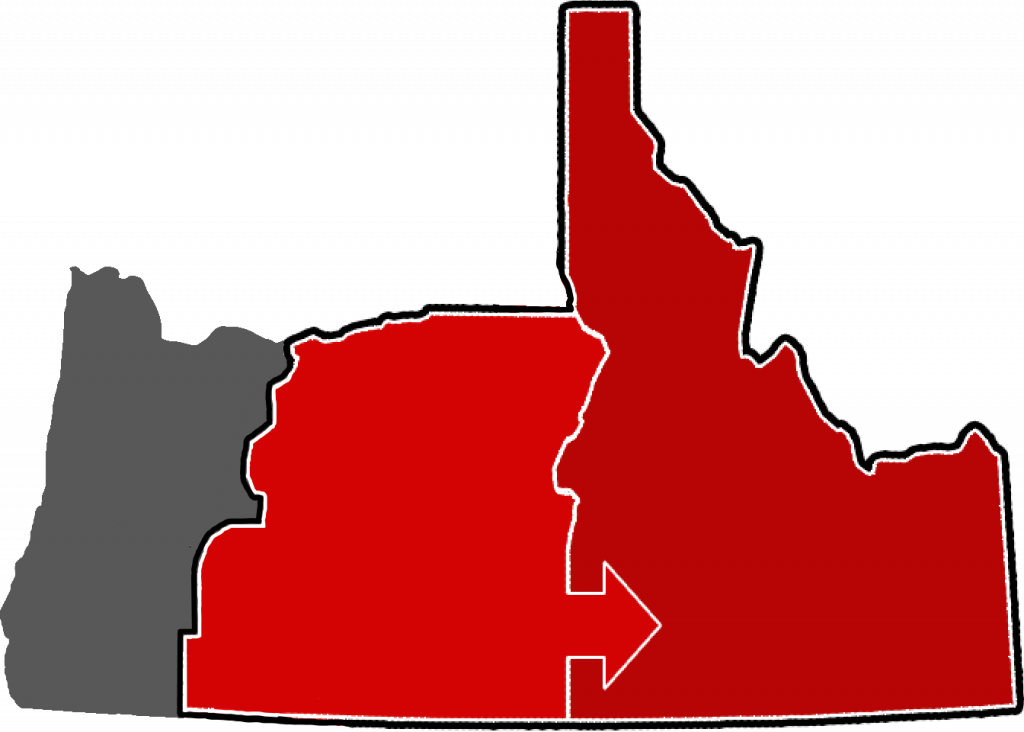

An in-depth economic analysis of the economics of the Greater Idaho proposal was published today by Points Consulting. The study finds that although Oregon’s spending per resident in northwestern Oregon is comparable to its spending per resident in eastern & southern Oregon, high-income areas around Portland end up carrying almost all of the state’s tax burden, due to Oregon’s choice of a progressive income tax to fund the bulk of its government.

This major study found that eastern & southern Oregon are a drain on Oregon’s state budget, but would be a benefit to Idaho’s state budget. This is because both eastern Oregonians and southern Oregonians have almost exactly the same per person personal income as Idahoans, but the income of northwestern Oregonians is much higher, according to recent US government BEA figures.

The 99-page report predicts that, under Idaho’s lower taxes and regulation, the economy of eastern & southern Oregon would surge, providing a big benefit to Idaho’s state budget. The benefit to Idaho’s budget of adding eastern & southern Oregon would be $170 million annually, according to this independent analysis, assuming Idaho leaves Oregon’s weight-mile tax on road freight in place in that area. Idaho itself does not have such a tax, but keeping this tax on eastern Oregon, not the rest of Idaho, is a part of the Greater Idaho proposal.

Yet, the average resident in northwestern Oregon overpays $360 in taxes to subsidize southern and eastern Oregon every year, according to the same study, or $690 per northwestern Oregon wage-earner. A poll last year found that only 3% of northwestern Oregon voters think that having eastern & southern Oregon on the state budget is worth this cost.

The study, which began in 2021, analyzed the impact of adding both eastern and southern Oregon to Idaho, although the Greater Idaho movement in May revised its proposal to not include southwestern Oregon into Idaho, until public opinion there embraces the idea.

The study demonstrated reasons that eastern & southern Oregon’s GDP would grow by 2.1% due to a border relocation, and the study acknowledged that the actual growth could be higher. It stated “Lastly, it is important to note that there are any number of economic possibilities that could result from the border relocation. Our effort with this analysis is to tabulate those which we can quantify and defend… the true impact could be larger than what is expressed here.”

The study cited several economic benefits to eastern & southern Oregon of joining Idaho, such as lower taxes, lower unemployment, and a lower cost of living.

The Greater Idaho movement responded to the study’s comments on debt by pointing out that Oregon’s state government has much more assets than debt, according to a tabulation by Truth in Accounting / University of Denver. In fact, the net assets of Oregon’s state government per resident are almost exactly equal to those of Idaho. Therefore, if eastern Oregonians brought their share of their state government’s assets and debts into Idaho, they would hardly change Idaho’s per-person net assets.

This independent analysis did not guess at what Idaho would agree to pay for eastern Oregon because the price would be entirely negotiable, and it would depend on which Oregon state assets and debts Idaho and Oregon agreed to transfer to Idaho. Less than three percent of eastern Oregon is state land; it is mostly federal or private land.

The analysis was performed by Points Consulting, an economic analysis firm based in Moscow, Idaho that has completed more than one hundred economic analyses over the last decade. Dr. Michael A. Shires, Vice Dean at Pepperdine University, was co-lead on the study. The analysis was sponsored by the Claremont Institute.

Matt McCaw, the Greater Idaho movement’s spokesman, said “we are asking Oregon Senate President Rob Wagner to give this proposal a hearing. It’s a win-win for both states, and a poll a year ago showed that 68% of northwestern Oregonian voters want it to have a hearing.”

A link to the study is here.